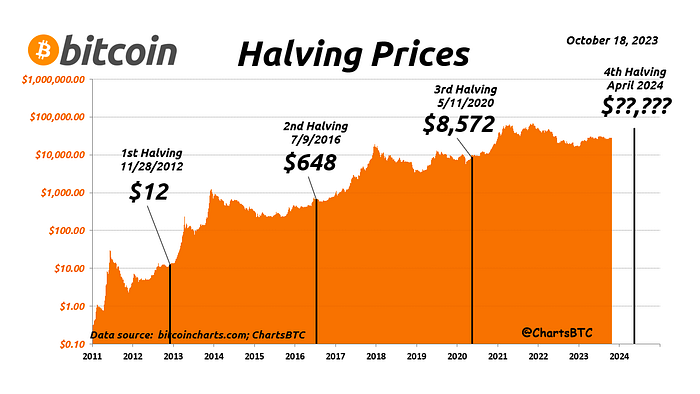

The crypto world is buzzing with excitement as the fourth Bitcoin halving has concluded, effectively reducing mining rewards and ramping up the cryptocurrency’s scarcity. This event, significant in the crypto calendar, is likely to push Bitcoin’s price upwards, assuming demand remains steady or increases. But the potential surge in Bitcoin isn’t the only opportunity on the horizon. Let’s dive into why this halving matters and explore three cryptocurrencies that might be worth your investment now: Bitcoin, Ethereum (ETH), and Polkadot (DOT).

Understanding the Bitcoin Halving

Bitcoin operates on a decentralized system where miners validate transactions and, in return, receive new bitcoins. The halving event, which occurs approximately every four years, cuts these rewards in half. This built-in scarcity is designed to curb inflation and enhance Bitcoin’s value over time. With the latest halving, miners now receive 3.125 BTC per block instead of 6.25 BTC, making Bitcoin even more scarce and potentially more valuable if demand holds or rises.

Bitcoin: The First and Foremost

Bitcoin remains the king of cryptocurrencies, and for good reason. With its reduced supply and increasing adoption, many experts, including Cathie Wood of ARK Invest, predict a bullish future. Wood believes that the combined effects of halving cycles and the introduction of spot Bitcoin exchange-traded funds (ETFs) could drive Bitcoin’s price to $1.5 million by 2030. More aggressive adoption could push it even higher, up to $3.8 million.

As traditional financial institutions gradually embrace digital currencies, Bitcoin’s value proposition as a store of value and hedge against inflation becomes clearer. For newcomers to the crypto space, Bitcoin should undoubtedly be a primary consideration.

Ethereum: The Versatile Workhorse

Ethereum often mirrors Bitcoin’s market movements but with an added flair due to its versatile platform. Ethereum’s blockchain supports smart contracts, which are self-executing contracts with the terms directly written into code. This functionality has made Ethereum the backbone of numerous decentralized applications (dApps) and other cryptocurrencies, many of which are ERC20 tokens based on the Ethereum network.

Ethereum’s potential for growth is substantial. Its ongoing transition to Ethereum 2.0, which aims to improve scalability and reduce energy consumption, adds another layer of optimism. Despite facing competition from faster and newer blockchains like Solana (SOL) and Cardano (ADA), Ethereum’s established ecosystem and continued innovation make it a strong contender for long-term gains.

Polkadot: The Underestimated Contender

While Bitcoin and Ethereum bask in the limelight, Polkadot represents a promising yet undervalued opportunity. Polkadot aims to enhance interoperability between different blockchains, which is a critical component for the future of a decentralized web, often referred to as Web3. The project, spearheaded by the Web3 Foundation, seeks to create a more interconnected and user-centric internet.

Polkadot’s performance has been lackluster in comparison to Bitcoin’s recent price surge, presenting a unique buying opportunity. Down by 34% over the last two years, Polkadot is poised for a rebound as the market catches up to the necessity of a decentralized and interoperable web. Investing in Polkadot now could offer substantial returns as the Web3 vision starts to materialize.

Conclusion

The Bitcoin halving is a pivotal event with the potential to uplift the entire cryptocurrency market. Bitcoin remains the cornerstone of any crypto investment strategy, thanks to its established status and significant potential for appreciation. Meanwhile, Ethereum’s smart contract capabilities and ongoing upgrades position it for continued success. Lastly, Polkadot’s focus on interoperability and Web3 ideals presents an intriguing investment at its current discounted price.

As always, investing in cryptocurrencies involves risks, and it’s essential to do thorough research and consider your financial goals and risk tolerance. With the crypto landscape continuously evolving, these three digital assets stand out as strong candidates for those looking to capitalize on the post-halving momentum.