Saudi Arabia Digital Health Market Size Forecast

Key Highlights

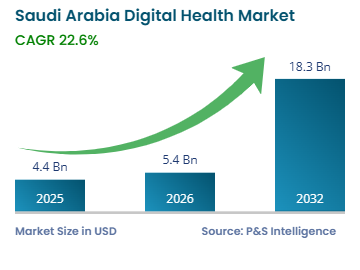

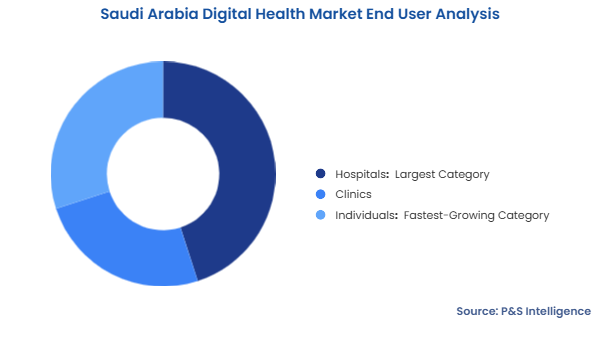

The Saudi Arabian digital health market is on a significant growth trajectory, with estimates predicting a market size of USD 4.4 billion in 2025. The sector is projected to grow at a compound annual growth rate (CAGR) of 22.6%, reaching USD 18.3 billion by 2032. This growth is largely influenced by the nation’s Vision 2030 healthcare transformation agenda, the rising prevalence of chronic diseases, particularly diabetes, and the increasing adoption of telemedicine and AI-enhanced healthcare solutions across both public and private sectors.

Snapshot Table

| Feature | Details |

|---|---|

| Study Period | 2019 – 2032 |

| Market Size in 2025 | USD 4.4 Billion |

| Market Size in 2026 | USD 5.4 Billion |

| Market Size by 2032 | USD 18.3 Billion |

| Projected CAGR | 22.6% |

| Largest Province | Al-Riyadh |

| Fastest-Growing Region Province | Makkah |

| Market Structure | Fragmented |

Saudi Arabia Digital Health Market Future Outlook

The future of the Saudi Arabian digital health market looks bright. Its estimated size of USD 4.4 billion in 2025 indicates a robust foundation for growth. This expansion is primarily fueled by the Saudi government’s Vision 2030 initiative, emphasizing healthcare transformation, and the pressing need to address the growing number of chronic diseases among the population.

Government investments exceeding USD 1.5 billion are aimed specifically at advancing healthcare IT and digital transformation. Landmark projects like the Seha Virtual Hospital, the world’s largest virtual healthcare facility capable of serving up to 400,000 patients annually, exemplify this transformation. Moreover, the youth demographic—63% of whom are under 30—combined with high smartphone penetration rates, is creating a favorable ecosystem for digital health innovations.

Saudi Arabia Digital Health Market Dynamics

Rapid Integration of Advanced Technologies

A key trend shaping the Saudi digital health market is the swift integration of advanced technologies. Supported by a strong technological infrastructure and high digital literacy, the kingdom enjoys one of the highest smartphone penetration rates in the region, with 78% of the population using 5G by early 2025. Notably, the government allocated USD 57.04 billion for health and social development, further promoting technological advancements in healthcare.

Seamless delivery of telemedicine, real-time health data exchange, and cloud-based solutions are now more accessible, thanks to the increasing adoption of cloud-based electronic health records. The integration of technologies like AI, blockchain for data security, and IoT devices for remote monitoring creates a sophisticated digital health ecosystem, attracting both domestic and international investments.

Vision 2030 Healthcare Digitalization as the Biggest Driver

The Vision 2030 initiative is the most significant driver of the digital health market’s progression. It established the Saudi Data & AI Authority (SDAIA) to advocate for AI integration and effective data utilization. The government’s commitment of USD 1.5 billion for health information technology has led to the implementation of national digital platforms like Sehhaty, Mawid, and Tawakkalna, enhancing access to health services for millions.

This initiative aims for a comprehensive overhaul of healthcare by digitizing 70% of patient activities and expanding telemedicine services to rural areas.

Saudi Arabia Digital Health Market Segmentation Analysis

Technology Analysis

In 2025, the telemedicine category is expected to hold the largest market share, facilitating remote consultations and addressing the healthcare access gap in the kingdom. Meanwhile, the mHealth category is anticipated to grow at the highest rate, with a remarkable CAGR of 22.8%. This category thrives on the popularity of health and fitness applications, chronic disease management tools, and partnerships that bundle health apps with mobile plans.

Technologies analyzed include:

- Mobile Health (mHealth) (Fastest-Growing Category)

- Electronic Health Records (EHR)

- Telemedicine (Largest Category)

- Healthcare Analytics

End User Analysis

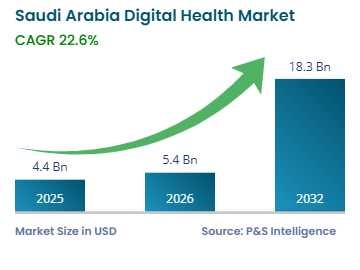

Hospitals are poised to dominate the market with a 45% share in 2025 as they lead digital transformations through the implementation of integrated health systems and AI tools. Conversely, the individuals category is expected to grow the fastest at 22.9%, indicating a shift toward consumer-driven healthcare and personal health management.

End users analyzed include:

- Hospitals (Largest Category)

- Clinics

- Individuals (Fastest-Growing Category)

Saudi Arabia Digital Health Market Geographical Analysis

Al-Riyadh Digital Health Market Size

As the capital and the province with the most advanced healthcare infrastructure, Al-Riyadh holds the largest market share at 35% in 2025. It serves as the pilot for national digital health programs, thanks to a concentration of government initiatives and advanced hospitals like the Seha Virtual Hospital.

Makkah Digital Health Market Size

Expect Makkah to experience the highest growth rate, with a CAGR of 22.7% due to robust digitalization initiatives. Under Vision 2030, Makkah’s hospitals are receiving amplified support for digital transformation, benefiting both local residents and the millions of annual pilgrims.

Eastern Province Digital Health Market Size

The Eastern Province, as an industrial core, represents a significant digital health market, leveraging investments from major corporations like Saudi Aramco to enhance employee health technologies. Young, educated workers drive demand for modern healthcare services, pushing rapid digital health adoption.

Key Provinces Include:

- Al-Riyadh (Largest Province)

- Makkah (Fastest-Growing Province)

- Eastern Province

- Madinah

- Qassim

- Asir

- Tabuk

- Ha’il

- Northern Borders

- Jazan

- Najran

- Al-Baha

- Al-Jouf

Saudi Arabia Digital Health Market Share

The Saudi digital health market is characterized by fragmentation, with numerous local startups and international tech giants competing in various segments. This diversity is particularly apparent in specialized areas such as telemedicine and mHealth applications, where many players meet specific healthcare needs. Government support continues to invite new entrants and foster collaborations between public and private sectors.

Key Companies Include:

- Athir

- Lean Business Services

- Al Nahdi Medical Company

- Cura Healthcare

- Sanar

- Labayh

- Vezeeta

- Okadoc

- Altibbi

- Sehhaty

- Tibbiyah

- MediSense

Saudi Arabia Digital Health Market News

- In June 2025, Alphaiota Ltd. and Powerful Medical s.r.o. expanded their partnership to introduce an AI-powered heart attack diagnostic platform to the Saudi market.

- In May 2025, Aramco Digital Company and LTIMindtree Limited established the joint venture NextEra to enhance digital transformation.

- In April 2025, Fakeeh Care Group and Fosun Pharma formed a partnership to provide advanced therapies in line with Vision 2030.

- In August 2024, the Saudi Ministry of Health launched a Regulatory Healthcare Sandbox for testing innovative solutions from startups in a controlled environment.

The interplay of government initiatives, technological advancements, and a growing health-conscious population indicates a promising future for the digital health landscape in Saudi Arabia.