The Rise of AI-Driven Phishing Scams and Web3 Exploits

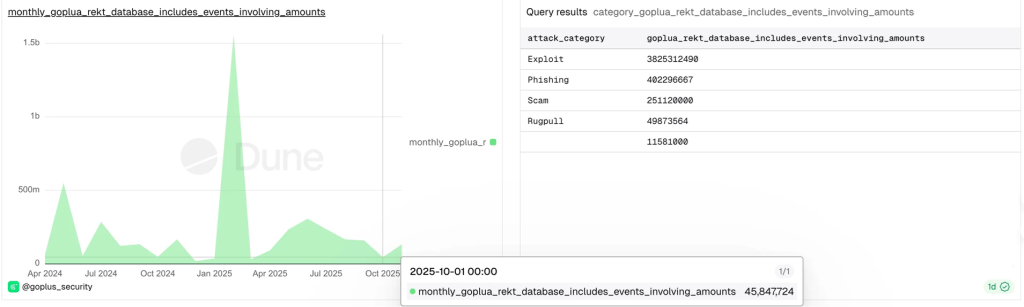

AI-driven phishing scams and exploitations have gone beyond simple cybercrime, posing serious challenges to the security of Web3. October witnessed staggering losses exceeding $45.8 million, as various sophisticated schemes unfolded. One notable case was the breach of SBI Crypto, which resulted in a loss of $21 million, echoing tactics akin to the notorious Lazarus Group, suspected of being linked to North Korean hackers.

October’s Financial Toll: A Closer Look

The numbers are staggering. Reports from GoPlus Security reveal that users suffered over $45.8 million in losses due to scams, exploits, and wallet breaches in just one month. With the rapid evolution of cybercrimes, it is crucial to understand the underlying methods and motivations driving these attacks.

Automated Scams: Phishing-as-a-Service

One of the most alarming trends is the rise of automated phishing through platforms that offer “Phishing-as-a-Service.” This allows cybercriminals to clone popular interfaces and launch extensive campaigns with minimal investment. The most severe incident recorded in October involved GMGN, where 107 users inadvertently approved fake transactions after being directed to a cloned site. Collectively, these errors resulted in losses exceeding $700,000 from the cloned site. Two other separate incidents led to losses of $325,000 and $440,000, respectively, when users unknowingly signed off on fraudulent commands.

SBI Crypto: A Case Study in Laundering Tactics

The breach at SBI Crypto, leading to a $21 million loss across various cryptocurrencies including BTC, ETH, and DOGE, illustrates the evolving landscape of cybercrime. The investigation into the incident revealed similarities with operations from North Korean hacker groups, particularly in the usage of Tornado Cash, a crypto mixer. This connection raises concerns about how stolen funds are laundered, showcasing a systematic approach reminiscent of past Lazarus Group operations.

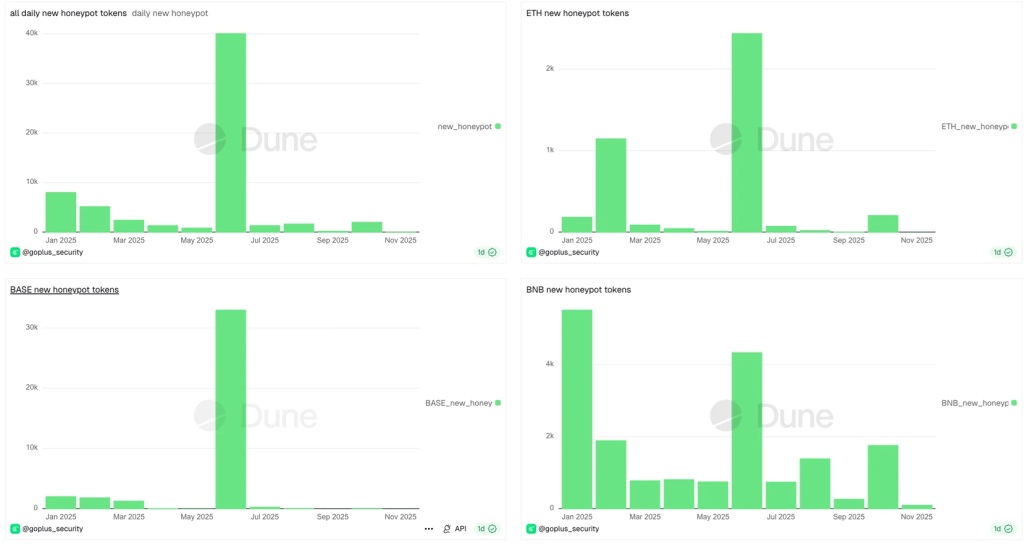

Honeypot Tokens: A New Layer of Deception

The surge in honeypot tokens, which allow users to buy tokens but block them from selling or withdrawing, has added yet another layer of complexity to Web3 security. In October alone, around 2,189 such tokens were identified, marking a 600% increase from the previous month. The majority of these tokens—1,780 instances—were found on the BNB Chain, while Ethereum and Base accounted for 216 and 131 cases, respectively. This trend signifies a growing number of schemes designed solely to trap unsuspecting investors.

Social Media and Decentralized Platforms Targeted

The exploitation of social media is also becoming more prevalent. A notable case involved Astra Nova, which lost $10.3 million due to a hack of its official account, exemplifying how vulnerabilities can extend beyond blockchain platforms. Similarly, Garden Finance experienced a security lapse that resulted in losses around $10.8 million for its users. These incidents underline the importance of protecting not just digital wallets but also the platforms that facilitate transactions and community engagement.

The Expanding Attack Surface of Web3

As the attack surface in Web3 continues to expand, the integration of artificial intelligence and complex contract exploitable vulnerabilities only heightens the risks. This shifting landscape indicates that threats are no longer solely linked to code vulnerabilities but also involve deteriorating user trust. More frequent and advanced attacks challenge the foundational security measures that have been previously sufficient. Decentralization, once seen as a bulwark against breaches, is becoming a double-edged sword that can be exploited by sophisticated operators.