The Ultimate Guide to Identity Theft Protection Services for 2025

Think your identity is safe? One of the most popular protection services actually left gaps we didn’t expect.

In today’s digital landscape, securing your personal identity isn’t just important—it’s a necessity. With the rising tide of cyber threats, having a reliable identity theft protection service is essential to safeguard your personal and financial information. This guide offers a comprehensive look at the top choices available, detailing their features, costs, and reliability when things go south.

Best Identity Theft Protection Services: Our Top Picks for 2025

After extensive research and testing, we highlight the leading identity theft protection services for 2025 based on their security, performance, and unique offerings:

-

Aura: Unmatched value with quick threat alerts and comprehensive features. Offers up to $5 million insurance for families.

-

NordProtect: A trusted name in cybersecurity with integrated identity protection.

-

Identity Guard: Features AI-driven monitoring and a family-friendly focus.

-

LifeLock: Solid reputation backed by Norton 360 for comprehensive protection.

-

IdentityIQ: Customizable coverage options paired with robust security features.

- IDShield: Family-oriented plans with access to licensed private investigators for added security.

Each of these services offers different strengths, from comprehensive monitoring tools to effective recovery assistance.

How We Chose the Best Identity Theft Protection Services

Selecting the right identity theft protection service can feel overwhelming. Here’s how we narrowed down the best options:

-

Cost and Value: We analyzed pricing to ensure that every service offers competitive features without excessive fees.

-

Discounts and Guarantees: We investigated promotional offers and money-back guarantees to give you the best possible deal.

-

Comprehensive Protection: We looked beyond basic monitoring to check for features like antivirus software, VPNs, and parental controls.

-

Credit Monitoring: The best services keep a watchful eye on all three major credit bureaus.

-

Dark Web Monitoring: We ensure that services actively look for your info on the dark web and provide timely alerts if it’s found.

- Identity Theft Insurance: We evaluated the insurance coverage provided, as this safety net can be crucial in the aftermath of a breach.

Our aim is to ensure you get the most value from your identity theft protection service while feeling secure about your personal information.

1. Aura — Best All-Around Identity Protection

| Aspect | Details |

|---|---|

| Starting Price | $12/month |

| Supported Platforms | Windows, macOS, Android, iOS |

| Three-Bureau Credit Monitoring | Yes (Experian, TransUnion, and Equifax) |

| Identity Theft Insurance | Up to $5 million |

| Best Deal | 68% Off Coupon |

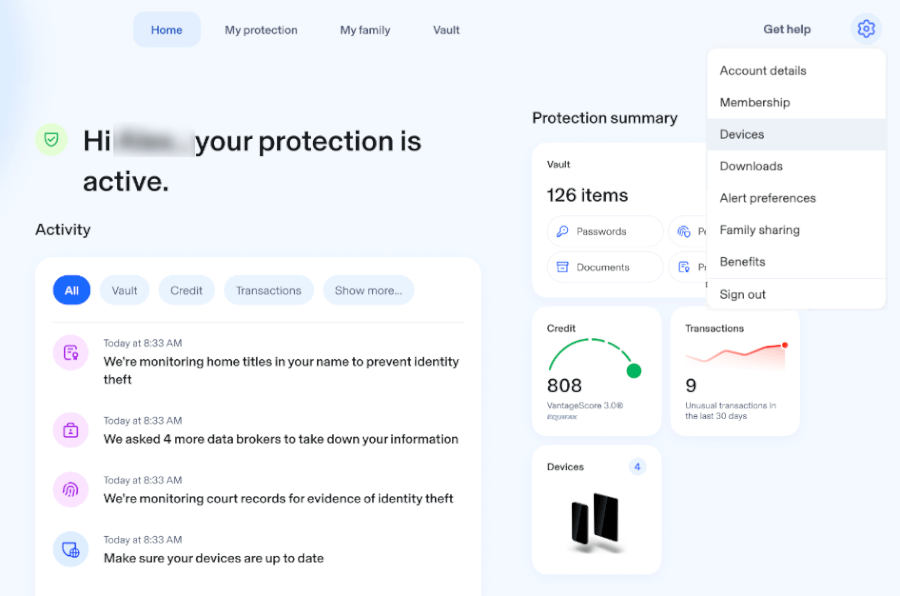

Aura excels in offering comprehensive identity protection, actively scanning for threats and providing timely alerts. Its additional feature, spam call protection, ensures that users can navigate their digital lives more securely. Notably, Aura offers up to $5 million in coverage for families, making it a preferred choice for those who want extensive protection.

Aura’s user-friendly dashboard allows users to access essential features like credit monitoring and dark web scans effortlessly. The service also comes with a built-in VPN and a password manager, enhancing its overall value. A unique aspect of Aura is its CreditLock feature, which enables users to prevent unauthorized access to their Experian credit report.

Aura Pros and Cons

Pros:

- Comprehensive identity theft protection

- Antivirus software included with all plans

- Dark web monitoring and fraud call protection

- Up to $1 million in insurance coverage

- 24/7 customer support

Cons:

- Lacks some advanced features present in premium plans

2. NordProtect — Trusted Identity Protection from the Makers of NordVPN

| Aspect | Details |

|---|---|

| Starting Price | $4.49/month |

| Supported Platforms | Windows, macOS, Android, iOS |

| Three-Bureau Credit Monitoring | No (TransUnion only) |

| Identity Theft Insurance | Up to $1 million |

| Best Deal | 70% Off Coupon |

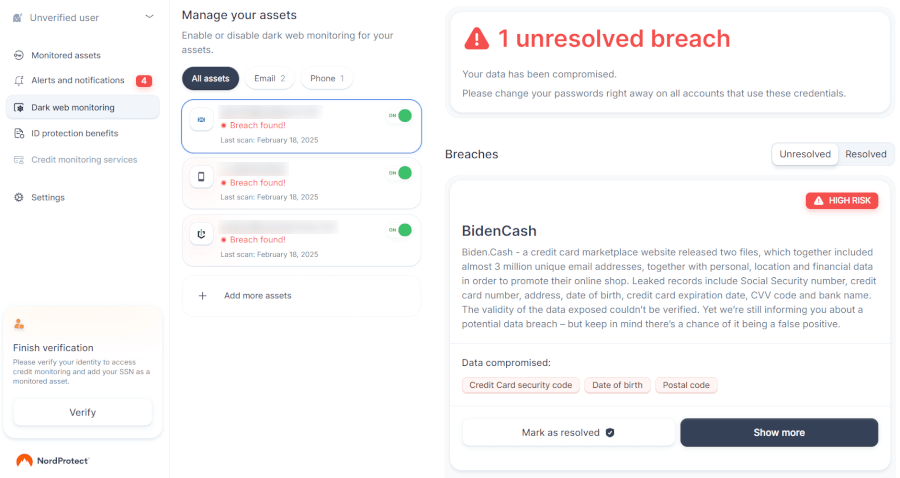

NordProtect integrates identity protection with cybersecurity features. It offers strong identity theft insurance and works seamlessly with NordVPN, making it an attractive choice for existing NordVPN users. The setup process is straightforward, and the user interface is clean and intuitive.

While lacking in some areas, such as coverage for all three credit bureaus, NordProtect compensates with features like cyber extortion protection, which are rare among its competitors.

NordProtect Pros and Cons

Pros:

- Integrated cybersecurity features

- Good pricing for foundational identity protection

- 24/7 dark web monitoring

Cons:

- No live chat support

- Limited credit monitoring to TransUnion

3. Identity Guard — Full-Spectrum Identity Theft Protection with AI Alerts

| Aspect | Details |

|---|---|

| Starting Price | $7.50/month |

| Supported Platforms | Windows, macOS, Android, iOS |

| Three-Bureau Credit Monitoring | Yes |

| Identity Theft Insurance | Up to $1 million |

| Best Deal | 63% Off Coupon |

Identity Guard leverages IBM Watson’s AI technology to deliver advanced monitoring. Users receive alerts about data breaches, suspicious transactions, and sightings on the dark web more quickly than with some other services.

While not the cheapest option, Identity Guard provides strong value through its comprehensive features and easy-to-navigate interface.

Identity Guard Pros and Cons

Pros:

- $1 million in identity theft insurance

- AI-powered identity monitoring

- Extensive alerts

Cons:

- Premium plans can be pricey

- Lacks a bundled VPN

4. LifeLock — Shielding Your Identity with Norton’s Full Support

| Aspect | Details |

|---|---|

| Starting Price | $7.50/month |

| Supported Platforms | Windows, macOS, Android, iOS |

| Three-Bureau Credit Monitoring | Yes |

| Identity Theft Insurance | Up to $3 million |

| Best Deal | 37% Off Coupon |

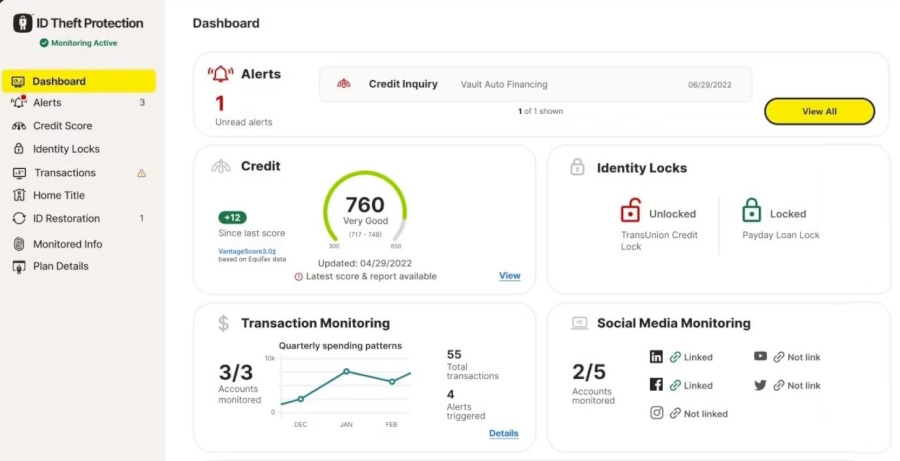

LifeLock partners with Norton 360 for comprehensive identity theft and antivirus protection. The service monitors key information and provides timely alerts to users.

LifeLock offers a user-friendly interface and solid customer support, including 24/7 assistance. However, be aware that certain benefits require higher-tier plans.

LifeLock Pros and Cons

Pros:

- 30-day free trial period

- Comprehensive identity protection

- User-friendly interface

Cons:

- Confusing plan structure

- Higher cost compared to some competitors

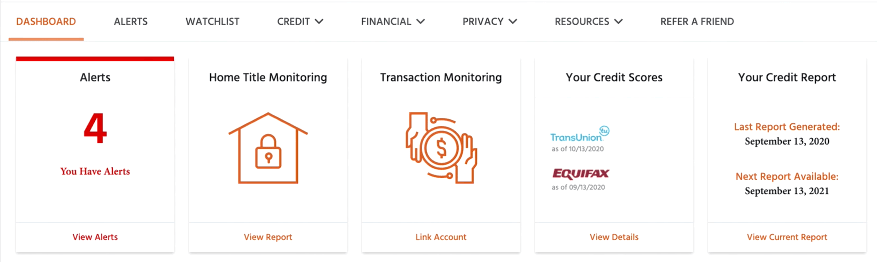

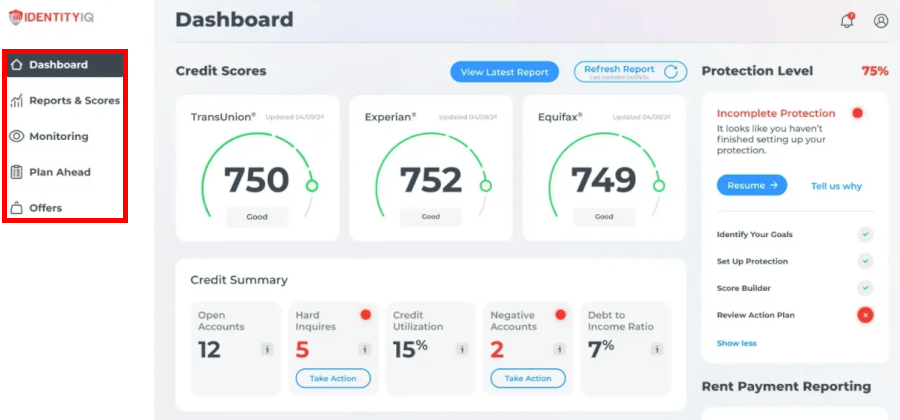

5. IdentityIQ — Scalable Coverage for Comprehensive Identity Security

| Aspect | Details |

|---|---|

| Starting Price | $8.49/month |

| Supported Platforms | Windows, macOS, Android, iOS |

| Three-Bureau Credit Monitoring | Yes |

| Identity Theft Insurance | Up to $1 million |

| Best Deal | 15% Off Coupon |

IdentityIQ offers graded plans to tailor coverage levels according to personal needs, including monthly credit reports as part of some subscriptions.

Their partnership with Bitdefender adds another layer of security with antivirus and VPN services.

IdentityIQ Pros and Cons

Pros:

- $1 million reimbursement for stolen funds

- User-friendly dashboard

- Monthly credit score updates

Cons:

- Data sharing with third parties

- Higher costs for additional features

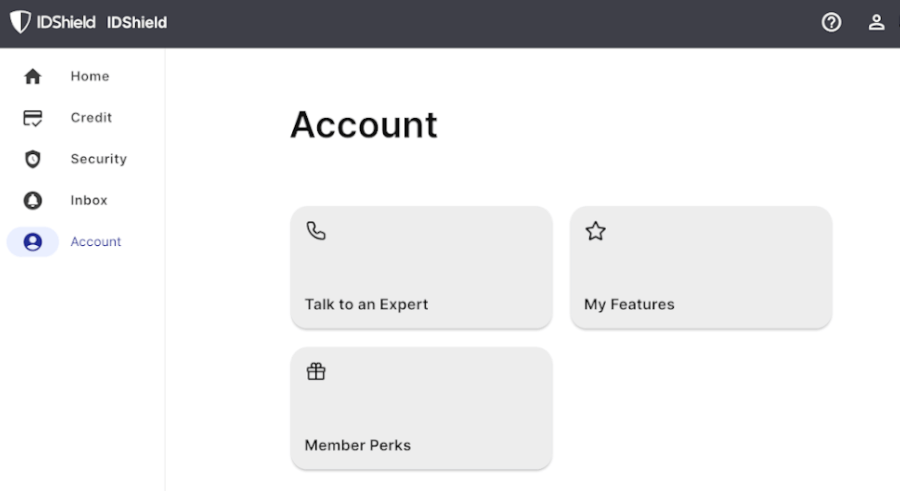

6. IDShield — Family-Focused Identity Protection at a Low Cost

| Aspect | Details |

|---|---|

| Starting Price | $14.95/month |

| Supported Platforms | Android, iOS |

| Three-Bureau Credit Monitoring | Yes |

| Identity Theft Insurance | Up to $3 million |

| Best Deal | N/A |

IDShield offers family plans that cover multiple members at a reasonable price. It also includes features like social media scans and a password manager.

Understanding Identity Theft Protection Services

Identity theft protection services are designed to monitor your personal information continuously and alert you to potential misuse. They scan for signs of identity theft, helping you catch suspicious activity before it escalates.

Key Features of Identity Theft Protection Services

- Personal Info Monitoring: Services track your personal information to detect unauthorized use.

- Account Monitoring: They keep an eye on financial accounts for any unusual activity.

- Real-Time Alerts: Most services inform you promptly about any suspicious activities.

- Recovery Assistance: Many offer proactive recovery support in case of identity theft.

- Insurance Coverage: Identity theft insurance helps cover costs associated with identity recovery, such as lost wages and legal fees.

How Identity Theft Protection Services Work

These services utilize advanced algorithms to scan vast amounts of data, ensuring that anything out of the ordinary is flagged promptly. Additionally, they frequently monitor credit files, public records, and dark web sites to keep you informed.

Tips for Choosing the Right Identity Theft Protection Service

- Assess Your Risks: Understand your personal data and how it might be targeted.

- Check Coverage: Look for services that monitor all three credit bureaus for maximum security.

- Evaluate Insurance Options: Understand what the identity theft insurance covers.

- Review Customer Support: Make sure the service offers accessible and responsive support.

- Utilize Free Trials: Many services offer trials which allow you to evaluate their features.

By weighing these factors and considering personal needs, you can find the ideal identity theft protection service to suit your lifestyle and budget.