Features of Identity Guard: A Comprehensive Review

In a world where identity theft is increasingly prevalent, services like Identity Guard are more essential than ever. Designed to detect the subtle signs of identity mishaps, Identity Guard offers tools that alert users quickly so they can act swiftly to mitigate potential damage. Monitoring credit accounts, financial transactions, the dark web, and relevant news reports, Identity Guard ensures that users are well-informed about potential threats.

We took a deep dive by signing up for Identity Guard’s Ultra plan, which provides a blanket of comprehensive protection. This package includes three-bureau credit monitoring, data breach notifications, and a white-glove fraud resolution service should our identity fall into the wrong hands. Additionally, our subscription offers monitoring of social media accounts, home titles, USPS changes, and more, making it particularly valuable if criminals attempt to create fake identities or accounts in our names.

>> Read More: A 2025 Guide to Personal Digital Security & Online Safety

From Our Experts: It’s important to remember that while identity theft protection services like Identity Guard can provide crucial monitoring, they cannot fully prevent identity theft. Their primary function is to identify early warning signs, allowing you to take action and protect yourself from significant losses.

Credit Monitoring

Credit monitoring stands out as a fundamental service most users anticipate from identity protection providers. Our experience with Identity Guard reinforced this assertion when our application for a student loan raised a flag through one of the major credit bureaus. For users worried about specific lines of credit, Identity Guard allows activation of fraud alerts to enhance security. However, it’s worth noting that credit and debit monitoring are exclusive to the Ultra plan.

In contrast, Identity Guard’s basic plans do not provide this feature. If budget constraints are a priority, alternatives like LifeLock might be worth considering. LifeLock offers one-bureau credit monitoring at a price point similar to Identity Guard’s lower-tier plan, which differentiates them in the competitive landscape of identity protection services.

Financial Monitoring

Identity thieves have the potential to cause damage that extends beyond mere credit score degradation. They may target your bank accounts, retirement funds, and even cryptocurrency wallets. Understanding this, Identity Guard closely monitors all financial transactions. The service provides insights into the personally identifiable information that financial institutions utilize for activity verification, helping users determine which aspects of their data need the most protection.

While the Value plan offers limited coverage for high-risk financial activities, our Ultra plan delivered a comprehensive suite of monitoring, encompassing credit cards, investment accounts, and retirement accounts, offering peace of mind with extensive coverage.

Identity Protection

Upon setting up our Identity Guard account, we provided critical data such as our name, address, birth date, and Social Security Number. The service performed an initial scan of the web and dark web to check for any existing issues, thankfully returning with no findings. Moving forward, it promises continuous 24/7 monitoring and alerts if our information appears anywhere online.

Here’s a snapshot of what our Identity Guard subscription encompassed:

- Dark Web Scan: The underground marketplace for stolen identities is thriving, and Identity Guard continuously scans these hidden corners of the internet. If our credentials were to surface, we would be alerted immediately.

- Criminal and Sex Offender Monitoring: If our names emerged on a sex offender registry or police report, we would receive immediate notifications—thankfully, this was not the case.

- USPS Address Change Monitoring: After changing our registered USPS address, Identity Guard notified us of the update on the same day. If it had been a thief forwarding our mail, we would have been alerted promptly.

- Home Title Monitoring: The service would notify us of any attempts to open a home title in our name or transfer it elsewhere.

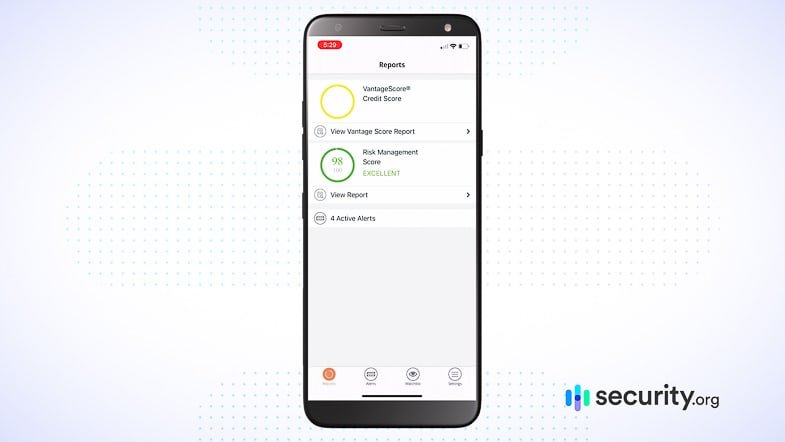

- Risk Management Report: Identity Guard generated a report assessing our risk level for identity fraud, offering valuable insight into our vulnerabilities.

- Safe Browsing Tools: We utilized Identity Guard’s browser extension to fend off ads, trackers, and phishing sites. It also protects against web mining, preventing unauthorized data collection.

- Anti-Phishing Mobile App: In addition to the standard app, we received access to the Anti-Phishing by Identity Guard mobile app, which successfully detected and blocked phishing attempts across various browsers.

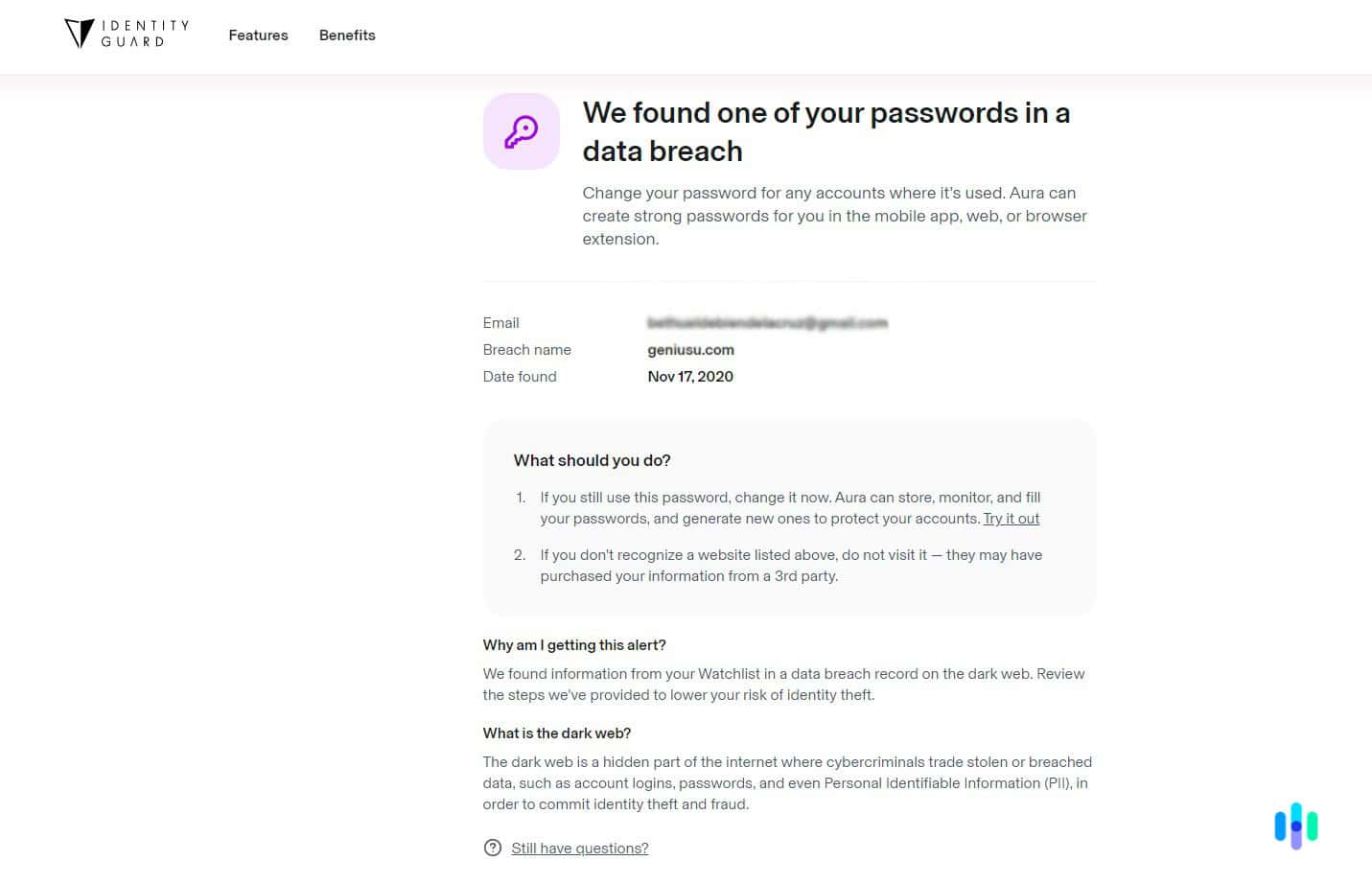

The alerts we received were impressively detailed. Shortly after enrolling, Identity Guard used our supplied information to conduct an initial scan, revealing a data breach associated with our email. Each alert included specifics about when and where the breach occurred as well as potential impacts, offering transparency that fosters trust in the service.

Pro Tip: If you prefer receiving fewer monitoring notifications, you might want to explore Aura. In our assessment of Aura, we found it maintains a lower volume of non-critical alerts, focusing instead on valuable, emergency-based notifications.

We appreciated how Identity Guard includes actionable steps in their alerts, guiding users through “What Should You Do?” It offers tailored tips to minimize the fallout of potential data breaches, saving users the trouble of extensive online searches for remedies.

Insurance and Restoration

As emphasized from the beginning, while identity protection services provide essential tools for monitoring, they cannot completely eliminate the risk of identity theft. Thus, adequate insurance and recovery services are crucial components of any reliable identity protection package.

Identity Guard offers up to $1 million in insurance for victims of identity theft. This coverage can include stolen funds, legal fees, lost wages, and even childcare expenses incurred during recovery. Although this aligns with industry norms, some competitors surpass it; for example, LifeLock offers up to $3 million through its Ultimate Plus plan, while McAfee+ Ultimate provides $2 million.

For users on the Ultra plan, Identity Guard assigns a dedicated case manager to assist in resolving issues. They take care of sending letters and filing disputes with creditors on your behalf—a significant time-saver, especially for those navigating the complexities involved in identity recovery.

Identity Guard’s Identity Theft Protection Features at a Glance

| Monthly cost for first-year plan | $7.50 – $25.00 |

|---|---|

| Credit score monitoring | Yes |

| Sex offender registry monitoring | Yes |

| Risk management report | Yes |

| Identity theft insurance reimbursement maximum | Up to $1 million |

| Live chat customer support | No |

| Customer information shared with third parties? | Yes |